Median Home Price in the Mid-Atlantic Region Hits a New High of $408,000, up 2.3% From a Year Ago, With Homes on the Market at a Historic Low

After modest supply gains this spring, buyers are finding fewer options with the number of active listings falling 11.4% year-over-year; second home buyers luckier as the coastal Del/Mar Coastal region was the only local market with inventory gains this month

Homes continue to sell quickly with half selling in a week or less, nearly as fast as during the height of the pandemic market

NORTH BETHESDA, Md., July 13, 2023 /PRNewswire/ — The Mid-Atlantic housing market seems to have missed the message that higher mortgage rates should stifle demand as buyers scramble to compete for a shrinking pool of listings. The number of available homes for sale in the Mid-Atlantic region has fallen to historic lows and home prices are once again at record highs, according to the Bright MLS Mid-Atlantic June Housing Report released today. Sales continue to trail last year, however, it’s not for lack of buyer interest.

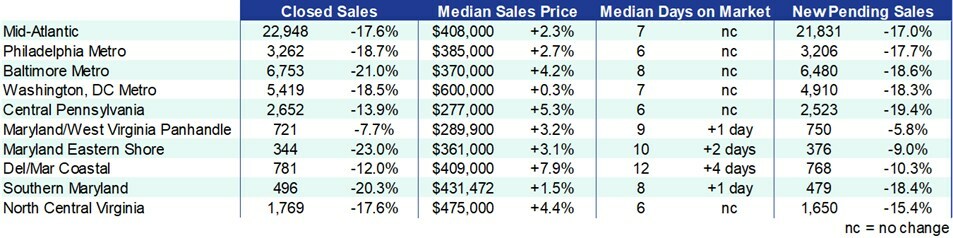

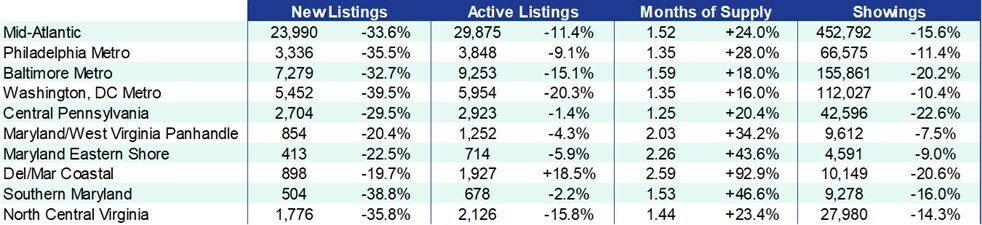

June Mid-Atlantic Housing Market by Region

June Mid-Atlantic Housing Market by Region

“The housing market in the six-state Mid-Atlantic region continues to defy expectations,” said Dr. Lisa Sturtevant, Bright MLS Chief Economist. “Strong buyer demand continues to push home prices to new records, while the absence of sellers is becoming even more apparent as new listings slowed to a trickle in June.”

At $408,000, the median home price in the Mid-Atlantic is 2.3% higher than a year ago, hitting a record high. Prices rose in most local markets and for all housing types. Condos, often the most affordable options for buyers, led the price growth in June, up 3.7% compared to a year ago. Homes are selling quickly, with half of all homes going under contract in a week or less.

Buyers had been hopeful for more options during the spring as supply began to increase. But any relief buyers saw from an uptick in inventory evaporated in June. With no incentive for homeowners locked into low mortgage rates to sell, new listing activity is being driven primarily by sales of necessity—and it is far from enough to meet demand. The number of active listings in June was down 11.4% compared to June 2022 and is 44.3% of the level in 2019.

A lack of inventory is the primary constraint on the Mid-Atlantic housing market. New pending sales declined 17% and closed sales were down 17.6% year-over-year across the region in June. The lack of inventory also is impacting showings, which were down nearly 16% from a year ago.

One market that offers more choices for buyers, particularly second home buyers, is the Del/Mar Coastal region, where the number of active listings was up 19% in June. Prices are still rising, but beach properties are more plentiful than they were a year ago.

“Buying a beach property during the pandemic made more sense for some families since they were not otherwise able to travel and could work and learn remotely for weeks or even months at a time,” said Sturtevant. “Now, that lifestyle isn’t possible for most people. It’s back to just a week or two of vacation during the year.”

Key Market Takeaways

Philadelphia Metro Area: Record High Prices, Record Low Inventory Challenge Buyers

Unlike some regions in the U.S. that saw home prices dip in recent months, price growth in Philadelphia has continued unabated. The median home price hit a record high of $370,000 in June, up 4.2% from a year ago. The largest obstacle in the market is lack of inventory. The number of new listings coming onto the market in June hit a two-decade low, falling 32.7% from last year. At the end of June, there was just 1.59 months of supply and the median days on market was 8, meaning that half of all homes sold in eight days or less.

The hottest markets in June were in the New Jersey suburbs. The median sales price saw double-digit increases in both Mercer County (+10.8% to $410,000) and Burlington County (+12.5% to $370,790.) However, supply was down in all local markets with the exception of Kent County, Delaware. In both Mercer County and Camden County, N.J., as well as Montgomery County, Pa., the number of active listings on the market at the end of June was down by more than 30% compared to a year ago.

Baltimore Metro Area: Relief from Moderating Home Prices is Short-Lived for Weary Home Shoppers

After two consecutive months of flat prices, the median home price was on the rise again in June, reaching a record $385,000. Active listings fell 9.1% year-over-year, and are nearly 38% lower than 2019 levels. Supply is very limited as the number of new listings are at a two-decade low. Both pending and closed sales are well below last year, down 17.7% and 18.7%, respectively. Buyers are out there—there are just very few options.

Baltimore’s suburban housing markets continue to be very resilient with the strongest price growth in Anne Arundel County (+10.5%). In the City of Baltimore, prices were flat year-over-year. Buyers in the market have to act quickly. The pace of home sales transactions remains just as brisk as it was during the height of the pandemic with the median days on market at six for the metro and only five in Baltimore, Harford and Howard counties.

Washington D.C. Metro Area: If There Were Only More Homes to Buy…

It is not high prices or elevated mortgage rates that is constraining the Washington area market, but rather low inventory that has kept closed sales down 18.5% compared to last year. Active listings declined for the third consecutive month, down 20.3% from June 2022. This June, home shoppers are finding just half of the listings they would have seen back in 2019. Home prices rose modestly in June after three consecutive months of declines. The metro area’s median home price was $600,000 in June.

Price trends across the region were a mixed bag in June, largely driven by the types of homes sold this month. Prices rose the most in Alexandria City, Va. (+15.5%). The median price in Washington, D.C.; Arlington County, Va., and Frederick County, Md. declined while prices were basically flat in Loudoun County, Va.

Several local markets saw greater than 30% declines year-over-year in active listings. Both Montgomery County and Frederick County, Md, have less than one month of supply. Homes are selling very quickly. The fastest-paced market was Fairfax County, Va. where the median days on market was five in June.

Central Pennsylvania: Low Inventory Pushes Prices to the Max

Although the market has shifted, there have been consistent price gains in the Central Pennsylvania region. In June 2023, the median home price reached a record high, $277,000. Still, this median price makes Central Pennsylvania relatively affordable compared to its nearby metros like Philadelphia. There is just 1.25 months of supply, the tightest inventory of all regions in Bright’s footprint.

Low inventory is holding prices firm; it is also holding transactions back. There were 19.4% fewer new pending sales and 13.9% fewer closed sales in June. New listings decreased 29.5% compared to last year. With fewer new listings, the inventory picture is unlikely to change in the near term.

Maryland/West Virginia Panhandle: Inventory Turns Around After Climbing 14 Months

Active listings in the Maryland/West Virginia Panhandle stopped their ascent in June 2023. Compared to June 2022, inventory was 4.3% lower, the first year-over-year decline in 14 months. Home prices peaked in May in the Maryland/West Virginia Panhandle, though there was a new record of $310,000 for single-family detached homes in June.

Overall, the Maryland/West Virginia Panhandle home’s typical price tag still makes it extremely affordable compared to other areas in the Bright footprint. Demand in the Maryland/West Virginia Panhandle remains robust, and its HDI is the highest among the metros in the Bright footprint. Continued demand without additional supply will keep prices stable or rising.

Southern Maryland: After Declines in Early 2023, Median Price Reaches New High

The median sales price in Southern Maryland was $431,472 in June, a new record. The median price was up 1.5%, pointing to a very competitive market for home shoppers in Southern Maryland. Inventory had been increasing in Southern Maryland during the spring, but in June that trend reversed, and the number of active listings decreased 2.2%. Elevated interest rates have impacted demand, but they are also “locking in” sellers, creating a scarcity of existing homes on the market.

Maryland Eastern Shore: Falling Inventory Will Continue Price Pressure, Sales and Listing Activity Continues to Lag 2022

Active listings fell for the second consecutive month in June, down 5.9% year-over-year. Despite a drop off in buyer activity throughout Maryland’s Eastern Shore, home shoppers continue to face high prices and a fast-moving market. These forces favor sellers with home prices up 3.1% year-over-year at $361,000, off just slightly from the record high median price in May.

Buyers looking on the Eastern Shore need to act quickly. The median days on market is at its lowest level since last year, now at 10 days. Low inventory will keep the market fast-paced through the summer.

Del/Mar Coastal: Does Rising Inventory Mean Second Homes Are So Last Year?

Known for its second homes and vacation rentals, DelMar Coastal was the only region within the Bright MLS footprint to record an increase in inventory in June. Active listings were up 18.5%, and months of supply stood at 2.59 at the end of June. Despite the increase in homes available for sale, the median sale price reached a record high $409,000 in June, up by 7.9% and the biggest gain of any region in the Bright footprint. Homes are also selling quickly, with half of all homes selling in 12 days or less.

Elevated interest rates have limited transactions. However, the number of closed sales in June 2023 was only 12.0% lower than a year ago, and the gap between last year’s and this year’s sales has been narrowing. Buyers are still looking and could find more options in the Del/Mar Coastal area this summer.

North Central Virginia: Quest for Affordability Pushes Townhome and Condo Prices to New Highs

Although overall market activity appears to have slowed in June based on showings and new pending contracts, limited inventory is keeping the North Central Virginia housing market very competitive. Active listings were down 35.8% year-over-year, and limited inventory pushed prices to record highs in the region. Homes are selling quickly, and buyers must be prepared to make an offer, despite high list prices and elevated mortgage rates.

The median sale price in North Central Virginia was up 4.4% year over year to $475,000, which is level with the record in May. While the price of single-family homes did not change month over month, the metro’s more affordable townhomes and condos climbed to new highs in June of $421,000 and $377,500, respectively.