By Andrea Riquier

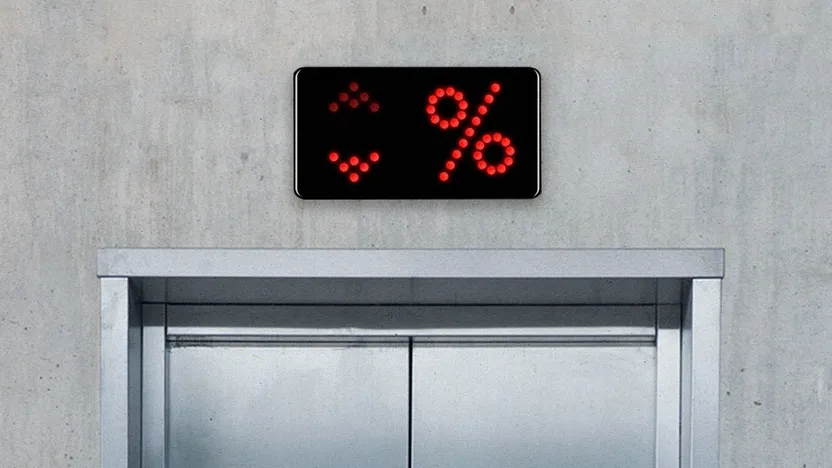

Despite signs that the economy might be slowing, mortgage rates crept higher for the second week in a row.

The interest rate on a 30-year fixed-rate mortgage averaged 6.43% in the week ending April 27, according to Freddie Mac. That’s up a little from last week’s 6.39%, and up a lot from last year’s 5.10%.

These rising rates, combined with higher home prices, have taken a toll on homebuyers’ budgets, with the cost of financing a typical house costing $611 more per month than it did a year ago, according to the Realtor.com® March housing trends report.

Yet homebuyers might find that the crushing affordability crisis they’re facing may soon ease up a little, particularly if the economy and inflation continue cooling.

“With the rate of inflation decelerating, rates should gently decline over the course of 2023,” predicts Sam Khater, chief economist of Freddie Mac. “The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.”

We’ll explore what it all means for hopeful homebuyers and prospective sellers on this latest edition of our column “How’s the Housing Market This Week?”

The latest trend in home prices

In addition to the prospect of lower mortgage rates, home prices—currently hovering at $424,000 in March—might also soon be on the wane. For the week ending April 22, listing prices were just 2.4% higher than a year ago. That’s the slowest growth rate we’ve seen since May 2020.

Plus, listing prices are simply what home sellers hope to get, and cash-strapped buyers these days are driving a harder bargain than ever.

“Even though potential sellers are still listing homes at higher prices, they aren’t necessarily getting what they’re asking for,” notes Realtor.com Chief Economist Danielle Hale in her weekly analysis.

In fact, the national median sale price of homes that actually reached the closing table declined on a yearly basis for the second straight month in March, the National Association of Realtors® said last week.

But that data is a bit deceptive, Hale points out, because the March decline “was driven entirely by declines in the West,” where prices have grown so much that many homebuyers set their sights elsewhere.

“Median home sale prices actually rose modestly in the Northeast, Midwest, and South,” Hale adds. This reflects migration to areas that remain relatively affordable by comparison.

Is it still a seller’s market?

Yet until mortgage rates start falling, homeowners who are thinking of selling seem to be stuck in wait-and-see mode. For the week ending April 22, the number of homeowners who’ve just listed their homes for sale is down by 21% compared with a year earlier.

“We are not seeing as many new home sellers as one year ago,” says Hale.

The reason for this standoff is yet again mortgage rates, with 82% of home sellers who hope to buy admitting that they feel “locked in” by the mortgage rate they have on their current property, which is often several percentage points lower than what they’d get now.

Granted, there are more homes for sale in total—39% more, to be exact—but much of that supply is either new construction or stale listings, which have been lingering on the market for months with no takers.

Plus, the pace of home sales has been slowing for the past 38 weeks, with homes spending an average of 17 days longer on the market for the week ending April 22 than at this time last year.

However, now that spring is slowly giving way to summer, the homebuying season is bound to pick up.

“We expect to see a growing number of home sellers, consistent with typical seasonal trends,” Hale predicts. And as supply expands, this translates into “better opportunities for buyers.”

Source: https://www.realtor.com/news/trends/mortgage-rates-creep-up-but-may-free-fall-this-year/